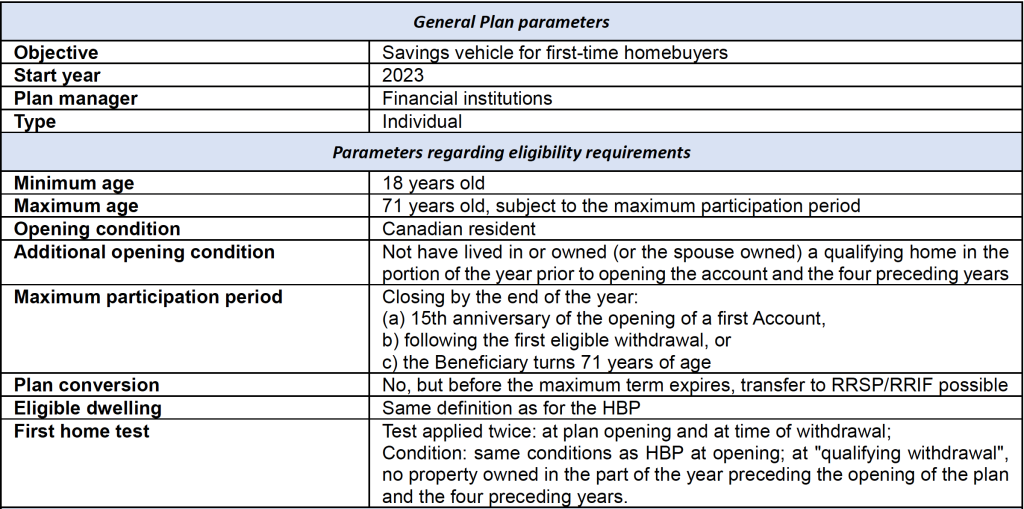

The FHSA is a new registered plan that will allow future homebuyers to save on a tax-free basis for their first home purchase. It will come into effect on April 1, 2023.

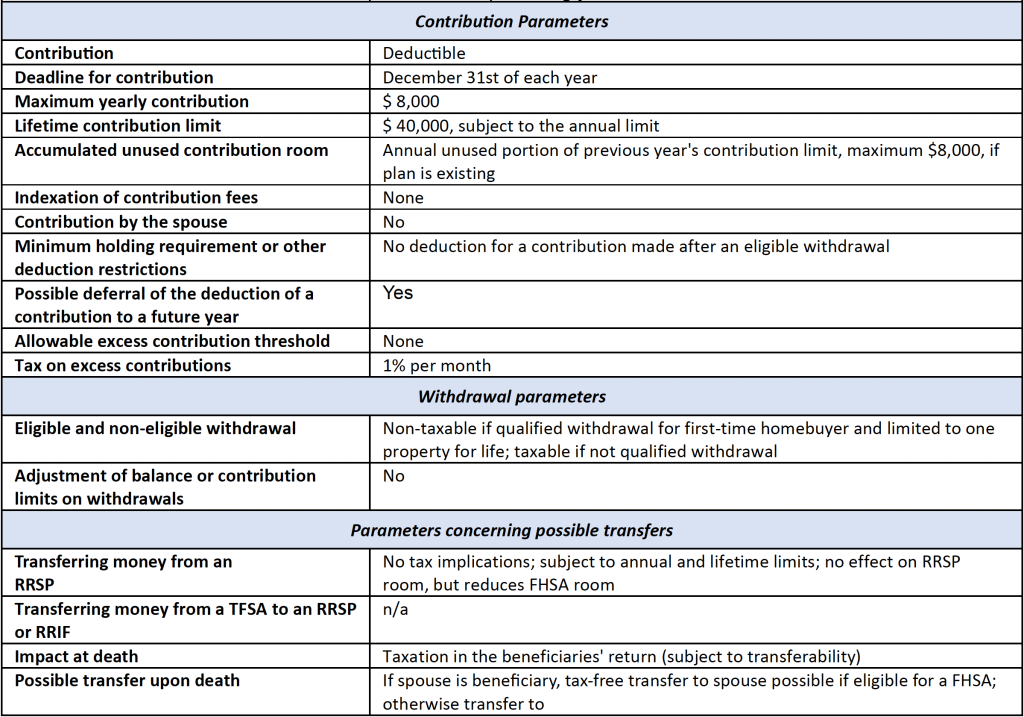

What is the maximum contribution amount?

The contribution limit is $8,000 per year for a lifetime maximum of $40,000.

For 2023, however, it will be possible to contribute up to $8,000, regardless of when you open your FHSA in that year.

Also, the unused portion of the limit is added to the following year’s entitlement (for example, if you contribute $6,000 in 2023, you can contribute up to $10,000 in 2024).

Under certain conditions, the amounts accumulated individually by each future homeowner can be pooled to purchase a first eligible home.

What are the benefits of FHSA?

Tax savings: the money contributed is eligible for a deduction, which will reduce taxable income for the current year and subsequent years.

Tax-free withdrawals: withdrawals for first-time home buyers, including investment income, will be tax-free.

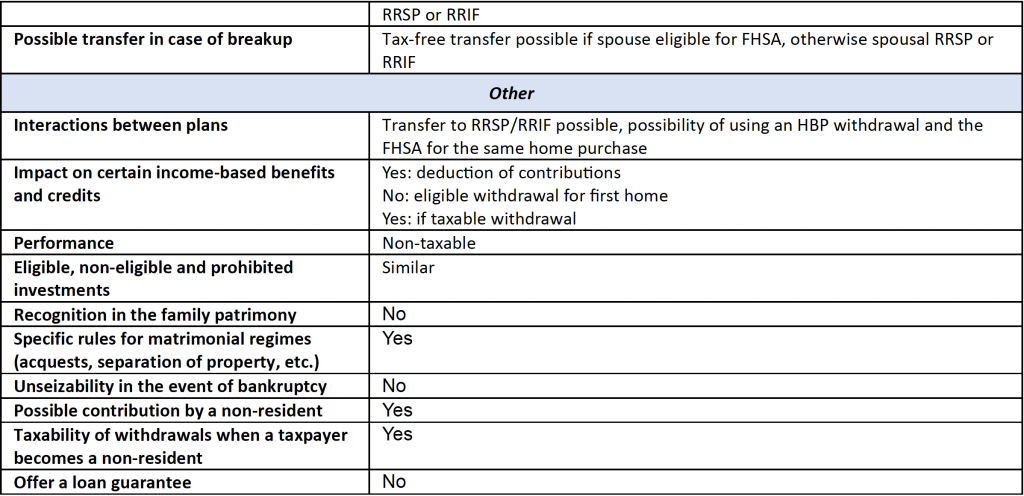

Tax-free transfers between registered plans: A transfer of funds from one FHSA to another FHSA, RRSP or Registered Retirement Income Fund (RRIF) would be possible on a tax-free basis. A transfer from an RRSP to a FHSA on a non-taxable basis would also be possible subject to the limit conditions and investment eligibility rules applicable to the FHSA.

Who is it for ?

You can open a FHSA account if:

- You are an individual;

- You are a resident of Canada;

- You are at least 18 years old;

- You or your spouse did not own a home in which you lived at any time during the part of the calendar year preceding the opening of the FHSA or at any time during the four preceding calendar years.

A share in a co-operative housing corporation that entitles the taxpayer to own (not rent) a housing unit located in Canada and to hold an equity interest in it would qualify.

What are qualified investments ?

The definitions of “qualified investment”, “non-qualified investment” and “prohibited investment” within the FHSA are the same as for the RRSP and TFSA.

What are eligible withdrawals ?

The following conditions must be met:

- Be a first-time home buyer at the time of withdrawal;

- Have a written agreement to purchase or construct a qualifying home before October 1 of the year following the year of withdrawal;

- Intend to occupy the qualifying home as a principal residence within one year of purchase or construction;

- The housing unit must be located in Canada.

A withdrawal remains eligible if it is made within 30 days of the individual moving into the home.

To make a qualifying withdrawal, an application to their FHSA issuer will need to be made by the taxpayer to confirm eligibility.

What are the limits ?

Limits on the amount that can be contributed: A 1% tax on over-contributions applies each month on the excess. This penalty can be eliminated by withdrawing the over-contributed amount. Otherwise, the amount over-contributed is deducted from the following year’s contribution limit.

Note that while an individual may have more than one FHSA, the limits (annual and lifelong) are calculated on the total amount contributed to all accounts.

Limits on holding period and age of beneficiary: your FHSA must be closed by December 31 of the year you turn 71 or by the 15th anniversary of the opening of your first FHSA.

You can then choose to :

- transfer the accumulated funds to an RRSP or RRIF, without affecting your RRSP contribution room and without paying taxes in the year of the transfer,

or

- withdraw the accumulated funds, but the tax on this amount will have to be paid.

Limits on contributions and who can deduct: It is not possible to contribute directly to another person’s FHSA. However, the FHSA holder will be able to contribute with money provided by another person. In all cases, only the FHSA holder can claim deductions for contributions made to their account.

Non-Resident limit: Taxpayers would be able to make contributions to their existing FHSAs after emigrating from Canada but would not be able to make a qualifying withdrawal as a non-resident. The taxpayer must be a resident of Canada at the time of the withdrawal and until a qualifying home is purchased or constructed. Withdrawals by non-residents would be subject to withholding tax.

Limit on borrowing to invest in a FHSA: Like interest expense paid on a loan to make a contribution to an RRSP or TFSA, interest expense paid to contribute to a FHSA is not deductible.

Bankruptcy: In the event of bankruptcy, unlike the unseizability of certain RRSPs, the FHSA would not have this feature.

Can it be combined with the HBP ?

Yes, both the FHSA and the Home Buyers’ Plan (HBP) can be withdrawn for the same qualifying home.